I think she is slowly recovering after hitting the low 0f 3.03 and close well at 3.22 looks rather positive!

If it is able to overcome the immediate resistance at 3.24 smoothly I think high probability she may rise up tobtest 3.31 than 3.40-3.45.

Huat ah!

Pls dyodd.

I think good opportunity is back!

At 3.08, yield is about 3.9%. Immediate support is at 3.07-3.08. Next support is 3.00 and 2.94.

Pls dyodd.

CapitaLand Investment - Results is out, not bad! Total Revenue is down 1% to 1345m, Operating PATMI is dien 1% to 344m, recurring FM fee grow by 10% to 183m, awesome!

I think Results is not bad and Operating profit is quite stable!

I think yearly dividend of 12 cents is sustainable and may be see further increase if FM fee grow faster than expected!

I have nibbled small unit at 3.26 yesterday during the closing!

Aiming for some kopi money!

At 3.26, the yield is about 3.65% if the yearly dividend is 12 cents.

She is due to report her 1st half results on 11th August that may provide us the clue how is the direction of the share price!

Not a call to buy or sell!

Please dyodd.

Let's monitor and wait for her to dip a bit to 3.22-3.26 and see if it can cross the resistance at 3.28 smoothly before taking further action !

At 3.29, yield is 3.6%.

Not a call to buy or sell!

Please dyodd.

Chart wise, bearish mode!

Likely to continue to trend lower!

Short term wise, I think she may go down to test 3.20.

Breaking down of 3.20 plus high volume she may continue to slide further down to 3.00 then 2.94.

Yearly dividend is 12 cents. Yield is about 3.72% at 3.22.

Please dyodd.

"CapitaLand Investment remains steadfast in being a trusted partner as we strengthen our position as a leading global real estate investment manager which delivers high quality returns."

CLI’s investment management leadership in Asia began about two decades ago, when we listed Singapore’s first real estate investment trust (REIT), CapitaLand Mall Trust. Today, our six listed funds across Singapore and Malaysia hold a Funds under Management (FUM) of approximately S$60 billion.

And that’s only part of the real estate portfolio that we’ve built — over S$29 billion FUM are also managed through a comprehensive and expanding private funds platform comprising more than 30 private vehicles.

Including assets held directly by CLI as well as assets managed through our global lodging platform, CLI oversees S$133 billion in Real Estate Assets Under Management (RE AUM).

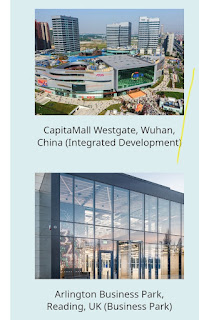

In addition to Singapore, CLI’s core markets include China and India. But our boots on the ground extend far beyond that, to markets across Asia Pacific, Europe, and the USA. Our real estate and management expertise has helped us amass a diversified portfolio of recognisable brands, operating platforms, and asset classes which include retail, office, lodging, business parks, industrial, logistics and data centres.

CapitaLand Investment's (CLI) listed funds business comprises five REITs and business trusts listed on the Singapore Exchange and one on Bursa Malaysia, with a total market capitalisation of S$32.2 billion1. Our listed funds portfolio is focused on driving sustainable distributions and increasing value for our unitholders.

Over time, we have built a strong track record as a Sponsor, making sure our listed funds are always efficiently structured and well-positioned for continued growth.

CapitaLand Investment managed the listed reit companies like Ascendas REIT, CapLand China Trust, CapLand Ibdia Trust, CapitaLand Integrated Commercial Trust and Ascott trust.

CapitaLand Investment (CLI) owns and manages over 1,000 quality properties across the globe, providing a wide range of integrated real estate solutions for work, live and play. The current assets pipeline on CLI's balance sheet provides a diversified stable of high-quality assets with visible monetisation potential.

With a full stack of investment and operating capabilities, we present a unique value proposition for our partners, investors, tenants and customers.