NAV 0.734.

Gearing is 35.7%(below 40%).

Yearly dividend of 5.22 cents.

yield is about 9.2% at 56.5 cents.

I think one of the rare Japan Logistics reit which is good to consider!

Chart wise, she has managed to bounce-off from 53.5 cents to close well at 56.5 cents, looks rather positive!

Hopefully, it can continue to rise higher to reclaim 60 cents level.

Not a call to buy or sell!

Pls dyodd.

I think she is trading at an attractive price level.

At 58 cents, yield is 9%.

Gearing is low. Wales of 6.6 years.

Pls dyodd.

Total NPI in JPY is up if not because of Stronger SGD dpu would be even higher.

I think the results is good as comparing with most of the reit were reporting lower NPI and lower dpu.

Yield of 8.42% is very good. NAV is 0.734.

Pls dyodd.

I think is a nice set of financial numbers!

NPI is up 5.2% YOY to 23.12m.

Dpu is up 0.4% from 2.6 cents to 2.61 cents.

Occupancy rate is 98.6%.

Achieve 100% Occupancy rate as at 31 July.

Gearing is of 35.7%.

Wale of 6.6 years.

Awesome.

XD 11 Aug. Pay date 26 Sept.

Estimating dpu of 2.61- 2.65 cents.

A nice breakout of 62 cents would likely see her testing 65.5-67 cents. Don't miss out!

Pls dyodd.

Results will be out on 3rd August 2023 AM, dividend is coming!

Chart wise, likely to retest 0.62 again!

A nice crossing over would likely push the price higher towards 0.655.

Pls dyodd.

Some snacks from Japan:

Hokkaido Cheese biscuits.

Milk chocolate biscuits.

Various types of snacks.

Strawberry cake.

Butter cookies.

Rice cookies.

Custard cookies.

Lai ah, jiak! Nom Nom!

Steam boat.

Chart wise, closed well at 0.62, looks rather bullish!

Likely to rise up to test 0.65.

Pls dyodd.

She is hovering near the 0.61 price level looks rather positive and may likely cross over smoothly!

Next, we can see her rising up to test 0.645-0.655.

Pls add dyodd.

Wah, breakout of 0.60 , awesome!

Short term wise, I think she is rising up to test 0.65 then 0.70-0.71.

Huat ah! Please dyodd.

Chart wise, bullish mode!

A nice breaking out of 0.595 plus high volume she may likely rise up to test 0.65.

Yearly dividend of 5.22 cents. Yield is 8.8%. Low gearing, wale is 6.9 years. I think it is trading at a great value price level of 0.59.

Not a call to buy or sell!

Pls dyodd.

Daiwa House Logistics Trust (DHLT) is a Singapore real estate investment trust (REIT) listed on the Singapore Exchange Securities Trading Limited (SGX-ST). The REIT is established with the investment strategy of principally investing, directly or indirectly, in a portfolio of income-producing logistics and industrial real estate assets located across Asia. DHLT’s investment focus will be to invest in logistics and industrial real estate assets in Asia, in particular, within Japan as well as in the ASEAN region.

DHLT’s key objectives are to provide Unitholders with regular and stable distributions, and to achieve long-term growth in DPU and net asset value per Unit, while maintaining an optimal capital structure and strengthening the portfolio in scale and quality.

DHLT is managed by Daiwa House Asset Management Asia Pte. Ltd., a wholly-owned subsidiary of the Sponsor, Daiwa House Industry Co., Ltd., a leading real estate player in Japan.

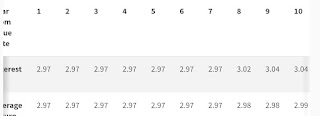

Occupancy % rate of 98.6. Gearing 36.2%. Wale 6.9 years. First quarter Distributable Income increased 2.5% to 9.1m.

Yearly dividend of 5.22 cents( half yearly basis ) . Yield is 9% base on current price of 0.58.

NAV of 0.77 .

It looks like a gem for this Logistics reit focusing in Japan of which was being sold down due to high interest rate situation.

I think gd value is presenting at the current price level!

Pls dyodd.