2nd quarter results is out!

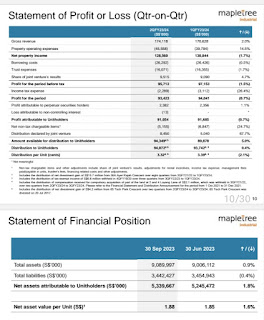

Gross Revenue is down 0.8% to 174m.

NPI is down 1.8% to 128.5m.

DPU is down 1.2% to 3.32 cents.

NAV is up 1.6% to 1.88.

XD 1st November.

I think the results is not bad considering current high interest rates environment!

borrowings costs is up 10.2%.

Fixed Loan of 79.2%.

Overall is not bad!

Pls dyodd.

Quote :

Mapletree Industrial Trust has been kept at "buy" by UOB Kay Hian's Jonathan Koh, along with a revised target price of $2.76, slightly higher from $2.74 indicated earlier.

https://www.theedgesingapore.com/capital/brokers-calls/uob-kay-hian-maintains-buy-call-mapletree-industrial-trust

I think boat is back!

At 2.19, yield is about 6.1% estimating yearly dividend of 13.4 cents.

NaV 1.86. Gearing is below 40%.

Chart wise, looks like she may go down to test the recent low of 2.17.

Next quarterly results will be out on 25th October, dividend is coming!

Not a call to buy or sell!

Please dyodd.

Mapletree Industrial Trust ("MIT") is a real estate investment trust listed on the Main Board of Singapore Exchange. Its principal investment strategy is to invest in a diversified portfolio of income-producing real estate used primarily for industrial purposes in Singapore and income-producing real estate used primarily as data centres worldwide beyond Singapore, as well as real estate-related assets.

As at 31 March 2023, MIT's total assets under management was S$8.8 billion, which comprised 85 properties in Singapore and 56 properties in North America (including 13 data centres held through the joint venture with Mapletree Investments Pte Ltd). MIT's property portfolio includes Data Centres, Hi-Tech Buildings, Business Park Buildings, Flatted Factories, Stack-up/Ramp-up Buildings and Light Industrial Buildings.

MIT is managed by Mapletree Industrial Trust Management Ltd. and sponsored by Mapletree Investments Pte Ltd.

NAV is about 1.8653.

Yearly dividend of about 13.4 cents.

Yield is about 6% at 2.21.

Occupancy rate is 94.9%.

Gearing 37.4%.

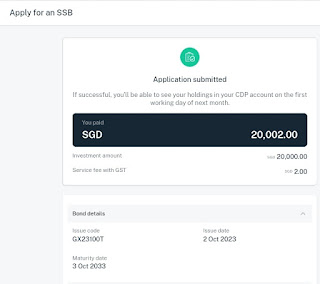

The recent Private placement of 204.8m for the acquisition of data centre in Japan,Osaka. Looks like dpu is accretive!

Looks like gd price is back!

Not a call to buy or sell!

Please dyodd.

The price has fallen below the recent Private placement price of 2.21, looks like a good pivot point!

Yield is about 6.11% based on current price of 2.18.

Immediate support is at 2.17.

Please dyodd.