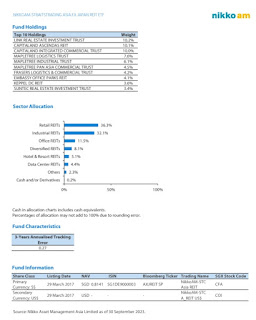

(CFA.SI) NIKKOAM-STC Asia ETF reit - Is a no-brainer strategy to get this counter that cover most of the famous reit counter like MIT, MLT, CLAR, CICT, MPACT, Suntec, Asia Link, FCT and FLCT etc. At 78.6 cents yield is considered very good at about 5.9 percent. Do take note!

NikkoAM-STC Asia ETF (CFA.SI) - dividend of 1.15 cents, XD 1st April, not bad! Collect dividend while waiting for price to recover!

At 78.7 cents yield is more than 5.8% looks like quite a good yield level to consider.

Pls dyodd.

NikkoAM-STC Asia ETF (CFA.SI) - I think No-brainer strategy to add this Reit ETF that consist of most of the famous reit counter like MIT, MLT, CLAR, CICT, FCT, FLCT, SUNTEC, LINK etc. Trading at 81.7 cents, yield is about 6.1 percent looks great for me! Pls dyodd.

Chart wise, she may rise up to test 83 than 85 to 87.

NikkoAM-STC Asia ETF Reit - I think great price is back! Having this counter is like owning most if tge famous Index reit like CLaR, CICT, MIT, MLT, MPACT, KDC, Suntec, Link (HK) . At 81cents yield is a whopping 6.1 percent, do take note!

Wah, nice closing at 82 cents!

I think high chance she may rise up to test 84 cents Than 88.5 cents!

Pls dyodd.

9th December 2023:

Chart wise, bullish mode!

I think likely to clear 82 cents and rises higher to test 84-84.5 cents.

A nice breakout smoothly will likely see her rising up to test 90 cents.

Pls dyodd.

I think she is slowly gaining momentum and likely to rise up further as US interest rate has peaked and paused and this is generally positive for reit and equity!

I think high probability of rising up to test 84 cents than 90 cents.

Pls dyodd.

Nibbled a bit at 0.801. Nice yield of more than 6%!

Chart wise, she is slowly recovering from the low of 0.73+ looks rather positive!

Pls dyodd.

NikkoAM-STC Asia REIT ETF (CFA.SI) - She is yielding 6.49% at 0.801, Quarterly dividend, I think is a good yield level to take note!

It covers most of the index reit like CapitaLand Integrated Commercial Trust, CapitaLand Ascendas REIT, Mapletree Ind Tr, Mapletree Logistics Trust, Frasers L&C Tr etc.

Chart wise, it has managed to bounce-off from the low of 73.6 cents and closed well at 0.802, looks rather bullish!

If this bullish momentum continue we may likely see her rising up further towards 90 cents and above.

Not a call to buy or sell!

Please dyodd.