Update: SSB(Singapore Saving Bond) - Last opportunity to secure an Average interest rate of 3.07 percent foe this no-brainer Fixed income product as interest rate may cut in Y2024 and the interest rate yield may also going lower! Last day to apply is on 26th December 2023! Do take note!

I am going to apply some to secure for this golden opportunity to lock in 3.07% for next 10-year.

Pls dyodd.

24 10 years average interest rate is 3.07% which is much lower than last month rate of 3.4%.

Total amount Offered is 1.1b.

I think the demand may be under subscribe!

Is it still quite a gd rate I certainly think so!

Last day to apply is on 26th December 2023.

Pls dyodd.

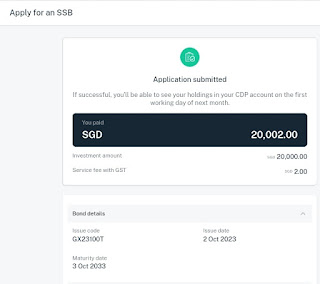

Results is out for Dec 2023 Batch.

All applicants will be alloted either 20k or 20m5k max. I think is not bad!

I think is a great interest yield of 3.4% for this fixed income product! It is backed by the gov.

Applied this morning to secure some!

Gd luck to All!

Pls dyodd.

I am going to apply by this weekend for December SSB offering average interest rate of 3.4% foe 10 years. Seem a very good yield to me higher than CPF OA.

Please dyodd.

Wah, Dec batch is yielding 3.4% average for 10 years , seems good!

Last day to apply is on 27th Nov 2023.

Offered Amount 1Billion.

Surely can get some.

Pls dyodd.

Results is out! I have secured fully for my application, swee!

Those who applied all being alloted with either 47,000 or 47,500. Bravo!

Waiting for next month announcements rate for December! I think might be the same or slightly higher.

Last day to apply is on 26th October!

Pls dyodd.

Stocks market is volatile!

I think good time to Apply a bit for Nov series to secure a fixed average yield of 3.32 % which is much higher than CPF OA.

Please dyodd.

Wah, Nov series average interest of 3.32% is higher than Oct interest of 3.16%, awesome!

I think likely to see an overwhelming response!

Total amount Offered is 1b. I think surely can get some.

Last day to apply is on 26th Oct.

Pls dyodd.

A safe and flexible way to save for the long term!

I think is a very gd fixed interest income that is even higher than AH Kong OA interest of 2.5%.

I have applied for this Oct 2023 of which I think is

quite a gd yield for me!

Please dyodd.

Wah, average 3.16 percent for Oct 2023 SSB, very good interest rate with little or no risk fixed income.

Tomorrow last day to apply for Oct 2023 series.

I have already applied hope for the Best!

Don't miss out!

Last day to apply 26th Oct 2023.

Amount Offered - 800m.

Huat ah!

Please dyodd.

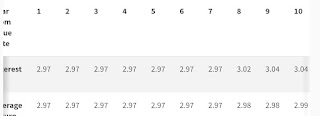

This month average 2.99% interest for 10 years duration is not bad!

Application Start from 3rd July to 26th July

I have been redeeming the old batch from 2018 and 2019 and re-apply for higher interest %.

This is the best option/flexibility for SSB.

Results is out for July SSB. All fully alloted!

Is under subscription for the total issurance of 600m.

Singapore Saving Bond - one of the best option to park your cash to earn a higher interest that spread across 10 years.

This month bond offering start from 1st June 6pm onwards to 26 June 2023 9pm.

Interest payment will be reflected as CDP-SBJUL23 in your bank statement

GX23070H in your SRS statement.

A safe and flexible way to save for the long term

The monthly issuance size of the Singapore Savings Bond (SSB) programme is S$600 million for this month. For more details, refer to the media release.

At the end of each year, on a compounded basis.

http://www.sgs.gov.sg/savingsbonds/Your-SSB/This-months-bond.aspx

Application may apply through: DBS/POSB, OCBC and UOB ATMs and Internet Banking and SRS. CPF funds are not eligible.

Invest amount : You can invest a minimum of $500, and in multiples of $500. The total amount of Savings Bonds held across all issues cannot be more than $200,000.

Interest Payment dates : Upcoming payment: 01 Jan 2024

Subsequent payments (until maturity): Every 6 months on 01 Jul and 01 Jan

Each Savings Bond has a term of 10 years and pays interest every 6 months. Savings Bonds cannot be traded like conventional bonds or shares. Interest income is exempt from tax. Only individuals above 18 years old can apply.

Savings Bonds are fully backed by the Singapore Government. And because the bonds can always be redeemed for the full amount invested, investors are protected against capital losses when interest rates change. This makes them one of the safest possible investments for individuals to hold.

Save up to 10 years, and earn interest that “steps up” or increases over time. Hold your Savings Bond for the full 10 years and receive an average interest per year that matches the return from 10-year Singapore Government Securities yields, which has generally been between 2%-3%.

Flexible :

Or, choose to exit your investment in any given month, with no penalties. There is no need to decide on a specific investment period at the start.

No comments:

Post a Comment